Energy costs are driving change in commercial real estate transactions. What should you do about it?

Many factors determine the value of a commercial building, including percent occupied, style, and location, location, location. Lately, we are seeing one more factor become important - Energy. And not just because dozens of cities and states already demand it (see: What Does an EUI Mandate Mean). Knowing how well a building uses energy will help the owner or manager rein in rising energy costs, attract tenants, and improve both the top and bottom lines.

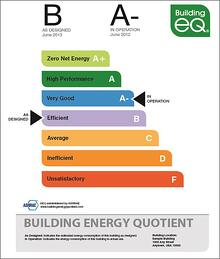

ASHRAE’s Building Energy Quotient (bEQ) not only gives the building a score, but also helps uncover opportunities to narrow the gap between the design and actual performance of the building.

Why Building Owners Care about bEQ

If space is leased, and the tenants pay the utility bills, it doesn’t matter how much energy the building uses. Right?

Wrong.

More and more, tenants factor in energy use costs when choosing a location. An energy efficient building may provide several benefits:

- Tenant is happy because they are not paying too much for something over which they have little control.

- Owner may be able to charge “premium” fees, and tenant may be willing to pay premium fees to be in a “green” and “sustainable” building.

- More of tenant’s money will go to the building owner, rather than to the utility company.

What the bEQ label means

“You cannot manage what you cannot measure.” Bill Hewlett of Hewlett Packard – and many other knowledgeable people.

An ASHRAE-certified Building Energy Assessment Professional (BEAP) can perform an In Operation Rating and provide a bEQ score that assesses the building’s actual energy consumption. The assessment includes an ASHRAE Level 1 Energy Audit, detail of annual energy use by fuel type (electricity, gas, steam, coal, etc.), and suggestions on where energy use can be improved. The building receives a letter grade from A+ to F, where B and above are efficient, C is average, and F, of course, is unsatisfactory.

What if the building’s bEQ is low? Good news – a low score means there is room for improvement, which usually comes in the way equipment is operated, in the equipment itself, or in maintenance staff training (and perhaps other employees and tenants too).

This is where the building owner decides, based on the reports, which investments make the most sense to lower operating costs and increase building value. Notice they are called “investments” not “expenses,” because an investment will pay you back over time, and an expense may not. One investment might be re-commissioning or retro-commissioning the building to determine if new or different HVAC or lighting equipment would improve performance. The return on investment (ROI) can vary from 10% to greater than 50%, depending on which energy-conserving measures the owner implements. There are many low- and no-cost ways to conserve energy, as detailed in this article, “Stop Wasting Money!”

A new building, one with with less than 12 months of utility bills, can have an “As Designed” analysis. Performed by an ASHRAE-certified Building Energy Modeling Professional (BEMP), it provides a bEQ score that rates the building’s projected energy consumption based on expected use and occupancy. It helps predict energy use and guides operations to ensure the building performs to its potential.

Once the proper equipment is installed, and the equipment is in optimum working condition -- thanks to proper and complete commissioning -- it needs to be maintained. That’s where training comes in. The maintenance staff (all shifts) must be properly trained on the equipment. For better results, engage tenants in energy efficiency practices.

Why Tenants Care about bEQ

This brings us back to Tenants. After all, a great-looking building that remains relatively unoccupied doesn’t do the owner any good. Tenants are becoming more knowledgeable when it comes to shopping for commercial real estate space. They want to know what their energy bills will be and factor that into monthly costs.

If a building lacks an energy rating (be it bEQ, Energy Star or LEED®), a potential tenant – or buyer - may ask “Is this a bad building or just not measured?” or even “Does the building owner invest in necessary operations and maintenance?” With a choice between two otherwise similar buildings, wouldn’t you choose the one that will cost less over time, and has some “green” cachet? (See this article in Forbes.)

An “efficient” bEQ rating can be a great selling point. The buyer will want to know what the energy costs are, and future tenants will want to know that they are in a high performance building, that their energy costs will be manageable, and that their building owner pays attention to operations and maintenance. Everybody wins.